You can invest in real estate using a variety of ways. You can invest in a single rental property, launch a billion-dollar real estate fund, or use one of the dozens of alternative strategies. The form of your real estate business is determined by your overall goals as well as the funds and resources available to you.

One typical technique is to generate funds through syndication with a private offering. However, understanding how to form a real estate investment trust, or REIT, may give you a superior solution for your situation.

REITs stand for Real Estate Investment Trust.

What are REITs?

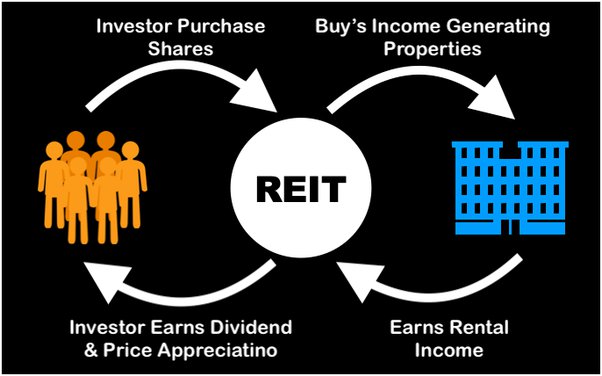

REITs are a suitable way for all investors to invest in large-scale, income-producing, efficiently managed commercial real estate companies. It is mainly an investment business in real estate that either owns, manages or finances income-producing real estate. They are similar to mutual funds. Through REITs, individual investors are now able to earn dividends from real estate investments without having to buy, manage, or finance any properties themselves.

Call Us at +91-9780664653, For A Free Site Visit To Your Dream Home

REITs provide investors with a steady income stream but little in the way of capital appreciation. Most REITs are publicly traded like stocks, making them extremely liquid. REITs own a wide range of real estate assets, including apartment buildings, cell towers, data centres, hotels, medical facilities, offices, retail centres, and warehouses.

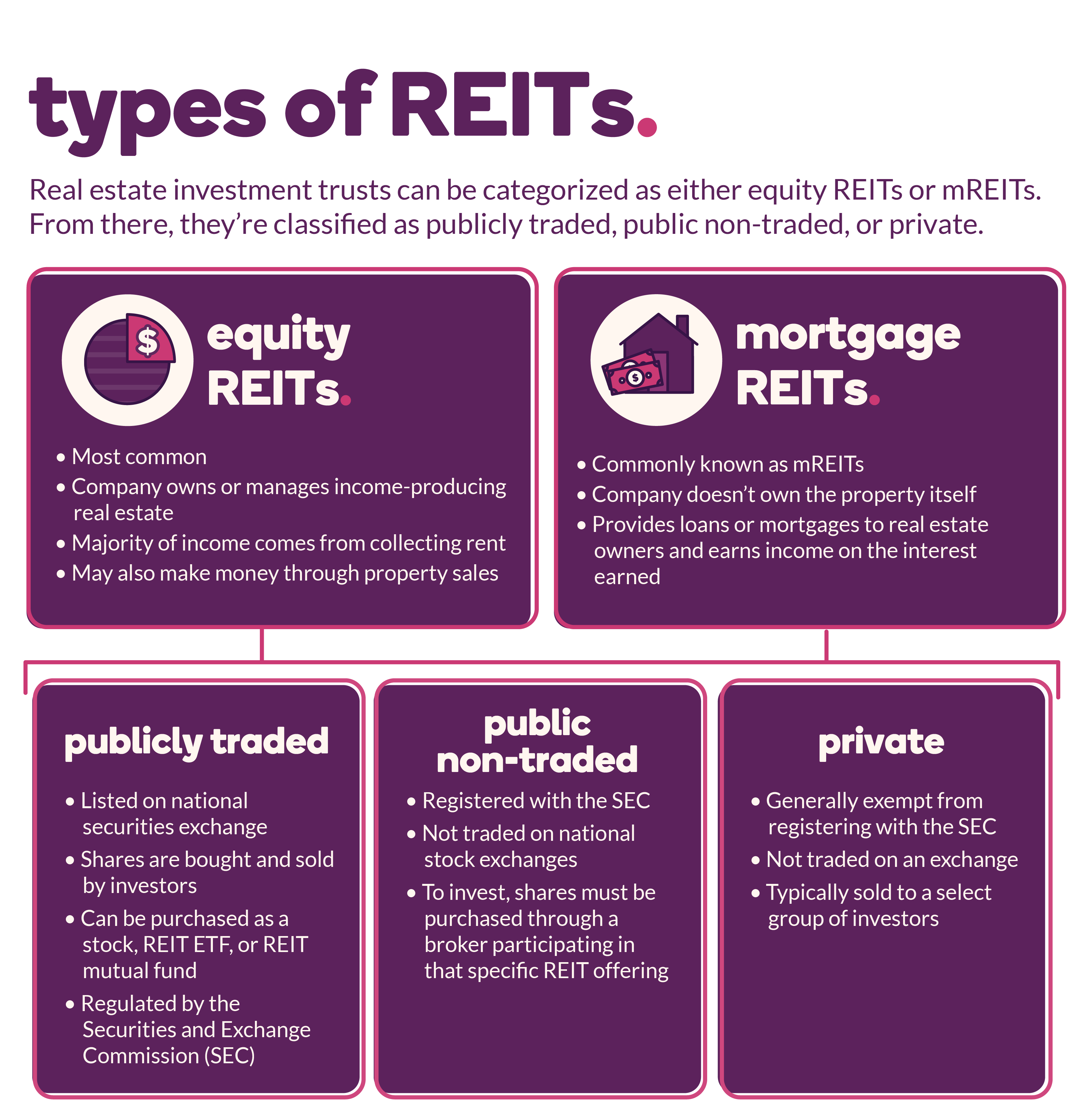

What types of REITs are there?

REITs are frequently classified as either equity or mortgage. The majority of equity REITs own and operate income-producing real estate whereas Mortgage REITs primarily lend money to real estate owners and operators directly or indirectly through the purchase of loans or mortgage-backed securities.

Equity REITs

Mortgage REITs are fundamentally based on debt, equity REITs are fundamentally based on the equity component of real estate ownership. The goal of these REITs is to generate rental income. A REIT, for example, may purchase an office building. Its revenue model is based on the rent paid by the businesses that occupy the office spaces. This captures the fundamental feature of equity REITs in terms of how they grow through rental income. Great Ajax Corp is an example of an equity real estate REIT.

Hybrids REITs

Another type of REIT is a hybrid REIT. Hybrid REITs are well-known for the fact that they invest in both equity and debt real estate. Using a hybrid investment model allows the REIT to reap the benefits of both equity and debt financing. Hybrid REITs have strong foundations, making them trustworthy investments. Its goal is to take gain from the profit of both equity and debt real estate. Parkway Life is a well-known REIT in which to invest.

What types of properties do REITs own and manage?

REITs own and supervise a wide range of property types, including neighbourhood shopping centres, health care services, apartments, single-family homes, cell towers, warehouses, office buildings, and hotels. Most REITs focus solely on one type of property, such as shopping malls, timberlands, data centres, or self-storage facilities. Some REITs invest across the country or, in some cases, the globe. Others focus on a specific region or even a single metropolitan area.

Who invests in REITs?

Everyone. Individual investors of all ages invest in REITs in the United States and around the world. Other common REIT buyers are family offices, pension funds, endowments, foundations, insurance companies, and bank trust departments.

Why start a REIT?

REITs offer better versatility than equity crowdfunding or real estate syndication. You don’t have to raise funds for every transaction and risk missing out on opportunities because you can’t respond quickly enough.

A REIT is a continuous enterprise that can move in and out of investments in order to maximise returns. Investors effectively agree to put their trust in your asset management talents in order to give you more flexibility in determining how to best use the funds available. With syndication, you must pitch investors to your vision and plan for each unique investment.

What are the benefits of investing in REITs?

REITs have outperformed stocks many times and have proved to be more profitable. REITs pay high dividends because they must disperse 90% of their taxable revenue to comply with IRS laws. However, most REITs pay out more than 90% of their taxable income since their cash flows, as measured by funds from operations (FFO), are sometimes significantly higher than net income because REITs depreciate heavily each year. If a REIT investor needed money, they could use their online brokerage account to sell REIT shares whenever the market was open.

REITs are extremely transparent. The performance of REITs is monitored by independent directors, analysts, auditors, and the financial media. They must also report their financial outcomes to the SEC. This oversight protects REIT investors by preventing management teams from taking advantage of them for personal benefit.

REITs have historically delivered strong returns. They also give various other advantages to investors, such as dividend income and diversification. As a result, they are an excellent addition to any investor’s portfolio.

Why were REITs created?

Congress formed REITs in 1960 to provide all investors, tiny investors, with access to income-producing real estate. President Dwight D. Eisenhower approved legislation that established a new way to income-producing real estate investment, combining the greatest characteristics of real estate and stock-based investing.